Rupee Gains of 35% Seen in Decisive Victory for Modi: Currencies

A victory for India’s main opposition party in next month’s general elections is seen powering the rupee to highs last reached in 2008.

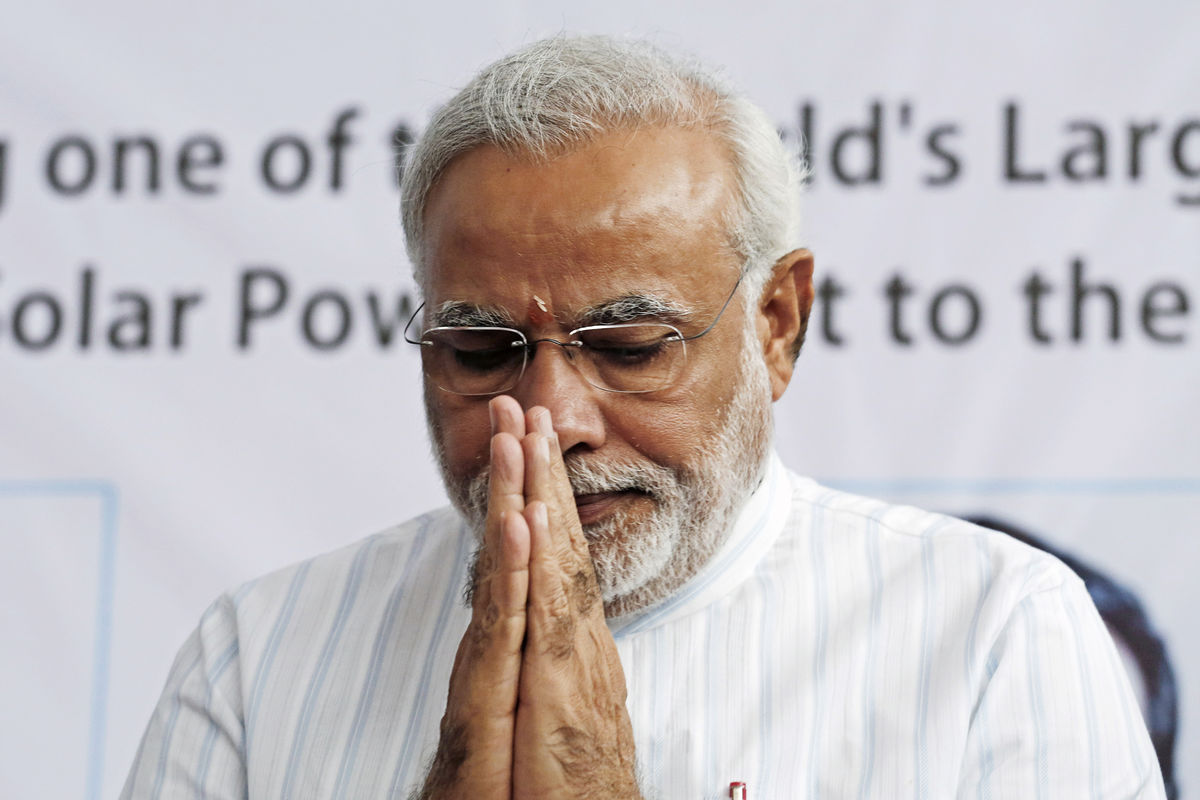

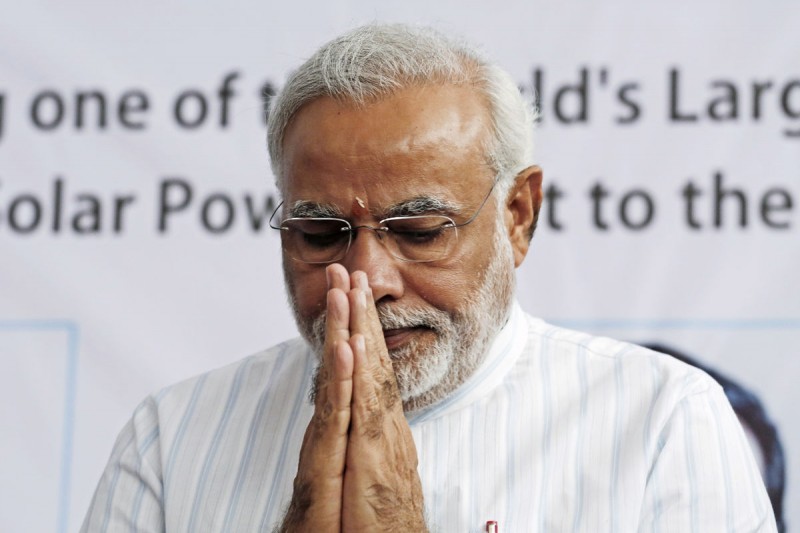

Polls show Narendra Modi’s Bharatiya Janata Party is poised to oust the incumbent Congress party, a result that would be a “catalyst” for a long-term advance in the rupee toward 40 to 45 per dollar, from 61.19 on March 14, according to Adam Gilmour, Citigroup Inc.’s head of Asia-Pacific currency and derivatives sales. A weak coalition would be the “worst-case” outcome, he said, and might send the currency sliding beyond August’s record low of 68.845.

“The market view is that if Modi gets in, it will be a game-changer,” Gilmour, who has worked at the second-largest currency trader for two decades, said in a March 12 interview in Singapore. “We always take politics with a pinch of salt, with the rare exceptions like India, where it’s going to really make a difference.”

At stake is the pace of recovery in Asia’s third-largest economy, which is only now gaining traction six years after the start of the global financial crisis. While an improvement in India’s current account helped the rupee beat its regional peers over the past six months, the victor in next month’s poll will take on the task of steering a country whose economy is expanding at close to the slowest pace in a decade.

Opinion Surveys

Polls by Nielsen and the Centre for the Study of Developing Societies predict Modi’s BJP will win the most seats, while falling short of a majority in the lower house of parliament. The Congress party is projected to achieve its smallest-ever number of seats.

The BJP and its allies will win as many as 232 parliament seats, 40 short of a majority, according to a poll released on March 6 by the CSDS. Election results are due May 16.

The rupee lost about 28 percent of its value from the end of 2010 through last year, making it the worst performer among 12 Asian currencies tracked by Bloomberg.

The declines reversed when the biggest gold-consuming nation raised import tariffs on the precious metal, helping narrow the shortfall in the broadest measure of trade to a four-year low, and central bank Governor Raghuram Rajan increased interest rates to curb Asia’s fastest inflation. The rupee has rebounded about 13 percent from its Aug. 28 record, and remained little changed even during the rout in emerging-market assets earlier this year.

‘Material Impact’

“The positive sentiment really comes from the new central bank governor,” Andy Ji, a Singapore-based strategist at Commonwealth Bank of Australia, said last week in a phone interview. “He’s had a more material impact on the rupee. Politics is just icing on the cake.”

For Citigroup’s Gilmour, politics, in the form of the elections that will be held across India from April to May, have the potential to affect the currency more than in most other countries.

Modi, the chief minister of the State of Gujarat in the northwest of the country, has the backing of business leaders and equity investors.

Billionaire Mukesh Ambani and Tata Group’s former Chairman Ratan Tata have praised the 63-year-old politician, who has pledged to bring more investment into the country should he succeed in ending Prime Minister Manmohan Singh’s decade-long rule. Rahul Gandhi, the 43-year-old scion of India’s foremost political dynasty and Congress vice president, has become Modi’s main opponent after Singh said in January he won’t stand for a third term.

‘Sell Dollars’

A jump in the rupee to as high as 40 per dollar would represent a 35 percent rally in India’s currency from the end of last week, and send it to the strongest level since April 2008. Gilmour’s prediction, for which he didn’t give a timeframe, is 5 rupees higher than the most bullish forecaster in a Bloomberg survey of more than 30 strategists, whose median estimate foresees the currency at 63 on Dec. 31 and at 58.50 by the end of 2016.

The rupee was at 61.21 as of 12:52 p.m. in New York, little changed from March 14. Indian markets were shut yesterday for a holiday.

“These are good levels to sell dollars against the rupee,” said Gilmour, 40. “Waiting until after the election could be way too late.”

Stocks Surge

India’s main stock index soared to record levels last week and today after opinion polls showed the BJP gaining ground as voters seek to punish the Congress for the economic slump and a series of graft scandals. Elections could be a catalyst for policies to revive economic growth, Goldman Sachs Group Inc. analysts including Sunil Koul wrote in a March 14 report. The bank raised India to overweight from market weight, meaning investors should hold a higher proportion of the nation’s shares that are represented in benchmark indexes.

“Investors are seeing this as a market-friendly type of result,” Khoon Goh, a Singapore-based currency strategist at Australia & New Zealand Banking Group Ltd., said in a March 13 phone interview. “The question remains whether we’ll see any major changes in policy if the BJP were to get into the government. A lot will also rest on the make-up of the coalition and how big a mandate the BJP gets.”

ANZ predicts the rupee will weaken about 6 percent to 65 per dollar by year-end as the U.S. Federal Reserve reduces its unprecedented economic stimulus program. The currency may head back up toward 60 in the following 12 to 18 months should India continue to cut its trade shortfall and the central bank succeed in bringing down inflation, Goh said.

‘Feel-Good Factor’

The current-account deficit will shrink to $45 billion in the year ending March 31, from a record $88 billion in the preceding 12 months, Finance Minister Palaniappan Chidambaram forecast last month. Overseas investors have added $1.14 billion to Indian stocks this year, the most among Asian markets tracked by Bloomberg after Indonesia and Taiwan, and pumped $6.18 billion into government bonds.

“There clearly is a feel-good factor in the markets,” Rohini Malkani and Anurag Jha, Mumbai-based analysts at Citigroup, wrote in a March 7 report. “Expectations are up, and so are equity and currency markets, which have also been buoyed by the real gains on deficit issues.”

While Gilmour sees a Modi victory as setting the stage for long-term gains in the rupee, Malkani and Jha estimate it will trade in a 60 to 64 per-dollar range over the next year. Singh’s administration, weakened by the departure of several allies, has passed the fewest bills for any Indian government to have completed a five-year term.

The government estimates gross domestic product will expand 4.9 percent in the 12 months ending March 31, near the previous year’s 4.5 percent, which was the weakest since 2003. The past decade’s annual average growth rate was about 8 percent.

“What everyone’s worried about is a quagmire of indecision,” Gilmour said. “A lot of hard decisions need to be made in India to fix it.”

Source: BloomBerg